Sage Intacct Financial Services

-

Introduction

-

Challenges

-

Benefits

-

Features

-

Take the Next Step

Introduction

Financial Systems for Financial Services Firms, including:

- Single- or multi-family office wealth and asset management

- Real estate companies

- Investment trusts

- Venture capital firms

- Private equity firms

- Lending institutions

- Insurance carriers

- Credit unions

A powerful, born-in-the-cloud financial management platform integrates with other best-of-breed solutions and makes it easy to share data. And with a modern user interface, flexibility, customisation options, advanced core financial information, and focused industry features, the right accounting software unlocks growth for your business.

The right financial management solution will provide unmatched multi-entity management and advanced financial reporting.

Vision33 helps you choose and implement the best solution for your business.

Challenges

When your business revolves around maximising growth and profitability while minimising costs and risks, your financial management tools significantly affect your bottom line.

The right financial management solution:

- Provides integrated financial and management reports across holding and operating companies in minutes, not hours

- Has the connectivity, visibility, and efficiency to drive optimal performance

- Offers detailed, real-time insights that empower you to make better decisions and enable strategic growth

- Allows you to do more with less

With the right software, you’ll get continuous consolidation and drill down across multiple funds so you can reduce your roll-up times and focus on strategy instead of paperwork. Quickly generating consolidated reports, sharing cross-entity data, and keeping your financial information audit-ready gives you unprecedented depth and visibility into your finances.

The right software for your business frees up resources for value-add activities by automating and streamlining processes like:

- Procurement

- Month-end close

- Consolidations

- Allocations

- Fund management

- Compliance reporting

Benefits

The Benefits of a Financial Management Solution for Financial Services Firms

A modern financial services firm management solution has work flow automation, multi-entity management, and native third-party integrations designed to meet your organisation’s needs.

At Vision33, we sell and implement modern software systems that ensure profitable operations and improved customer satisfaction for thousands of companies—regardless of your specific financial services specialty. Our customers include:

- Wealth and asset management

- Real estate

- Venture capitalists

- Private equity

- Insurance

- Lending

By combining smooth operational work flows with greater financial visibility, you connect your asset management on a single, efficient platform that maximises productivity and scales with your business.

With a modern software platform designed for growing financial services firms, you can:

Automate consolidations. Shave days or weeks off your monthly close time with multi-entity management. Never wait for month-end to get up-to-date, consolidated business information.

Adapt faster. Get fast answers to crucial business questions and respond to changing market demands. Reports that took months to complete are now available in minutes.

Maximise profits. Use dimensional accounting and native pivot-type reporting to track and filter metrics. Slice and dice data to identify profitability for multiple dimensions (e.g., project, department, client, and service type). Operate more efficiently and stay focused on the value-add priorities that drive growth.

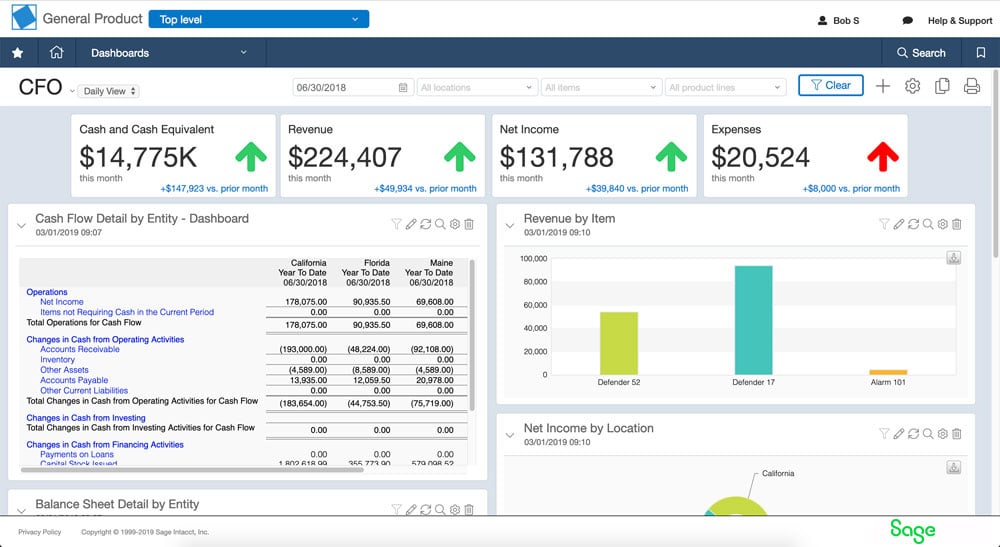

Streamline operations. Eliminate manual accounting tasks with automated work flows, real-time dashboards, and focused financial services industry functionality.

Optimise resources. Get instant visibility into KPIs and other metrics. Use improved insights and real-time dashboard reporting to make strategic decisions.

Centralise data across business applications. Seamlessly connect your CRM, industry tools, or other business applications to your platform for a single, integrated system.

Features

Best-in-Class Features

The accounting solutions offered by Vision33 include:

- Industry-leading, powerful core financial information

- User-friendly reporting and dashboards

- Advanced functionality tailor-made for financial services firms

- Multi-entity and global consolidations

- Multiple reporting and tracking dimensions

- Dynamic allocations

- Time and expense management

- Contract and subscription billing

- Automation for investment, capital, and claims reporting tasks

- Real-time visibility into metrics

- Less paperwork, more time for strategizing

Take the Next Step

Let's Discuss Your Business Challenges

Take the next step by exploring our product information gallery full of brochures, videos, and more to learn about the different ERP systems Vision33 offers.

You can also browse our success stories to see what our customers have to say about how ERP has helped them run simple, grow fast, and drive profit.

Then let’s discuss your financial services firm’s growth challenges and which ERP system will help you reach the next milestone in your mission. Vision33 provides the right balance of software and consulting to maximize financial services firms’ investment in transformative enterprise technologies. Contact us to chat with a certified Vision33 consultant about your financial management needs.

Frequently Asked Questions (FAQs)

-

What types of organisations can benefit from financial management solutions?

Single-family or multi-family office wealth and asset management firms, real estate companies, investment trusts, venture capital firms, private equity firms, lending institutions, insurance carriers, and credit unions can benefit from financial management solutions.

-

How do I get support for my financial and cloud solutions?

A modern financial services management solution has workflow automation, multi-entity management, and native third-party integrations to meet your organisation’s needs. Vision33 sells, implements, and supports modern software systems that ensure profitable operations and improved customer satisfaction for thousands of companies—regardless of your financial services speciality.

-

Can I consolidate my financial information across multiple platforms?

Yes. With the right software, you’ll get continuous consolidation and drill down across multiple funds so you can reduce your roll-up times and focus on strategy instead of paperwork. Quickly generating consolidated reports, sharing cross-entity data, and keeping your financials audit-ready gives you unprecedented depth and visibility into your finances.